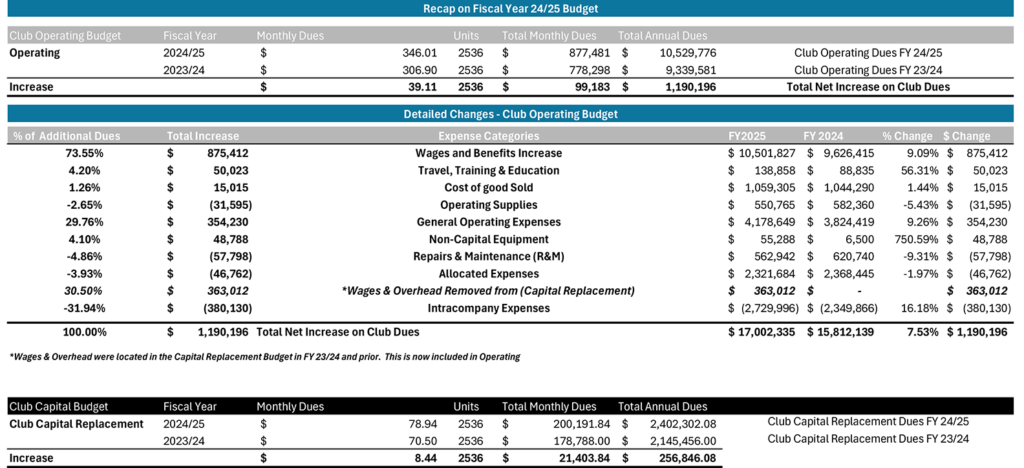

Question: Howard Blumstein recently pointed out that the FY25 $47.55 increase in the monthly assessment generates an additional $1,447,042 in Club revenues over the previous year. The Major Expense Categories increase shown in the FY25 budget documents as approved by the Club Board is $1,025,042. Why was an additional $422,000 in revenues needed?

CBOD Response: We are correcting the allocation of labor cost to the appropriate category. In recent years the cost of our staff labor and overhead has been allocated to capital projects not operating expense. Based on last year’s audit recommendation we have corrected this practice so that in the future all labor related expenses will appear as an operating expense.

The additional $422,000 in revenues beyond the major expense increases is primarily due to the reallocation of wages and overhead from the capital budget to the operating budget, and general increases in operating expenses such as insurance which increase by 27% or $51,900 and other non-capital equipment. The edited recap of the FY25 budget in the accompanying table includes the wages and overhead. The increase matches the major category expenses. It is important to note that the $422k figure represents a combination of both operating dues and capital replacement contributions.

Thank You for your question highlighting an important change in our accounting practices.