The Club Board is considering amending CPo 305—the Investment Policy. I have received a few comments on the proposed changes. Allow me to explain the rationale behind the proposed changes and to provide a few additional pieces of information.

Capital funds here at The Villages come from Club Member Dues. There will be two line items on your dues statement, replacement capital and improvement capital. Capital Replacement is used to maintain our existing infrastructure (paint, carpeting, A/C units, electrical panels). Capital Improvement is used to add infrastructure (bocce courts, patio cover at Bistro, new sound and lighting at the auditorium). Many of our assets are more than 50 years old. The current replacement capital fund income is insufficient to cover the ongoing depreciation of our assets. In addition to underfunding, our buying power decreases rapidly over time due to inflation.

The Board has several goals with respect to these funds. We must maintain our assets while controlling Club Dues. To this end, we are looking at ways to invest our cash to hedge against inflation and ensure we have enough in the fund to keep our community vibrant. If we choose an investment strategy with a lower rate of return, we will be required to increase Club Dues to cover expenses.

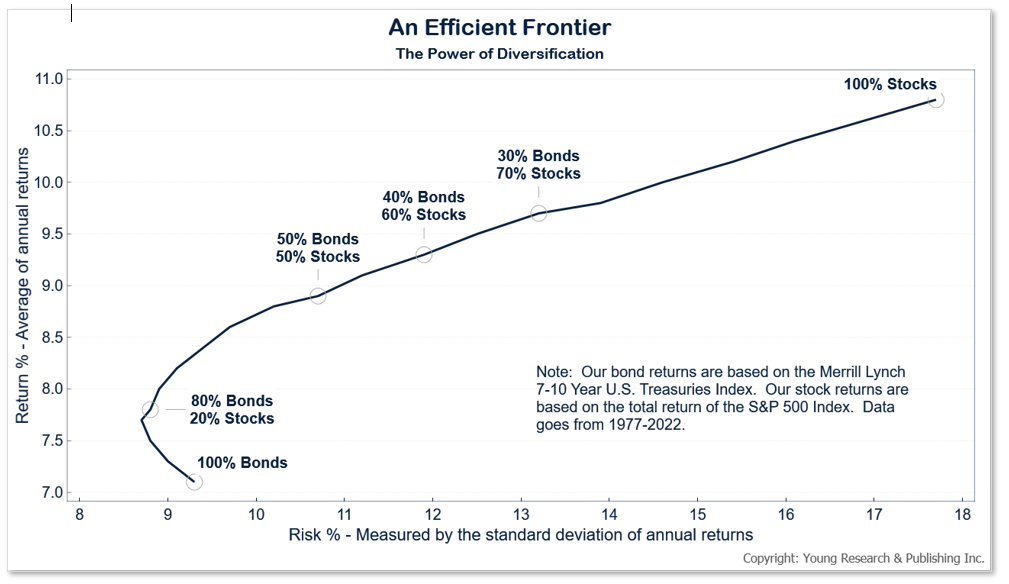

Several of you have discussed the inherent risk associated with equities without discussion of the equally real risk that inflation poses. Interest rates, generally, do not keep up with the rate of inflation. Equities, on the other hand, generally do. In 1952 Harry Markowitz formulated the “efficient frontier” portfolio (https://en.wikipedia.org/wiki/Efficient_frontier). He was awarded the Nobel Prize in Economics in 1990 for his efforts. A portfolio is referred to as “efficient” if it has the best possible expected level of return for its level of risk. Please see the chart below:

A portfolio of 100% bonds and one that is 70% bonds, and 30% equities have the same risk percentage (see the “X” Axis on the image below) yet the portfolio with the equity component produces an average rate of return nearly 1.25% higher.

In conjunction with our investment advisors, who are fiduciaries, we are proposing to add an equity component that will keep us on the efficient frontier. That means that while we expect to achieve better returns, our exposure to risk remains the same. The upside of the equity component offsets the dilution that inflation creates. Similarly, the bond elements offset the potential downturn of our equity elements.

While most of us are thinking about managing our assets for the next 10 to 15 years, the Board has a responsibility to take a longer-term view. We need to insure the viability, and, therefore, property values of our community for 30+ years.

We appreciate your interest in our proposed policy changes. I hope that the above information addresses your concerns.

—Andy Altman, Club Board Treasurer